Mutual Funds in India made simple – know benefits, types, SIP, and tax-saving options. Start investing smartly with just ₹500 per month in 2025.

🎧 Prefer listening?

Before you start reading, listen to a short Hindi audio overview of this post — it gives you a quick idea about the topic in just a minute.

If you are thinking about savings and investment, you must have heard the term Mutual Fund.

Understanding the concept of Mutual Fund in India can greatly enhance your investment strategy.

Investors often turn to Mutual Fund in India for diversification and professional management of their portfolios.

A Mutual Fund is an investment vehicle where money from many investors is pooled together and managed by a professional Fund Manager. This money is then invested across different asset classes such as:

- Stock Market

- Bonds

- Government Securities

- Gold

So, your money becomes part of a large fund.

With the rise of technology, investing in Mutual Fund in India has become more accessible than ever.

5 remarkable Benefits of Investing in Mutual Funds in India

Exploring the benefits of Mutual Fund in India can help you make informed financial decisions.

- Diversification – Your money is invested across multiple asset classes like equity, debt, and gold, which helps reduce overall risk.

- Professional Management – Your investment is managed by experienced Fund Managers who make informed decisions on your behalf.

- Start Small – You can begin investing with as little as ₹500 or ₹1,000 per month through SIP (Systematic Investment Plan), making it affordable for everyone.

- Liquidity – Mutual funds offer easy withdrawal options. Most schemes are flexible, though some may charge a 1% exit load if redeemed within the first year. After one year, many funds have zero exit load, making them a convenient investment choice.

- Better Returns – Over the long term, mutual funds have the potential to deliver higher returns compared to traditional savings instruments like Fixed Deposits (FDs) or Recurring Deposits (RDs), helping you grow wealth faster.

Types of Mutual Funds in India

- Equity Mutual Funds – These funds invest mainly in company stocks. They come with higher risk but also higher return potential, making them suitable for long-term wealth creation.

- Debt Mutual Funds – These invest in bonds, government securities, and other fixed-income instruments. They are low-risk funds and provide stable and predictable returns, ideal for conservative investors.

- Hybrid Mutual Funds – A smart mix of equity and debt investments. They offer a balanced approach, reducing risk while giving better returns than traditional savings.

- Index Funds / ETFs – These track popular market indices like Nifty 50 or Sensex. They are low-cost funds and are great for investors who prefer simple and passive investing.

Many investors are drawn to Mutual Fund in India due to their potential for better returns.

What is SIP in Mutual Fund in India?

Understanding the different types of Mutual Fund in India is essential for effective portfolio management.

SIP or Systematic Investment Plan is one of the most popular ways to invest in mutual funds.

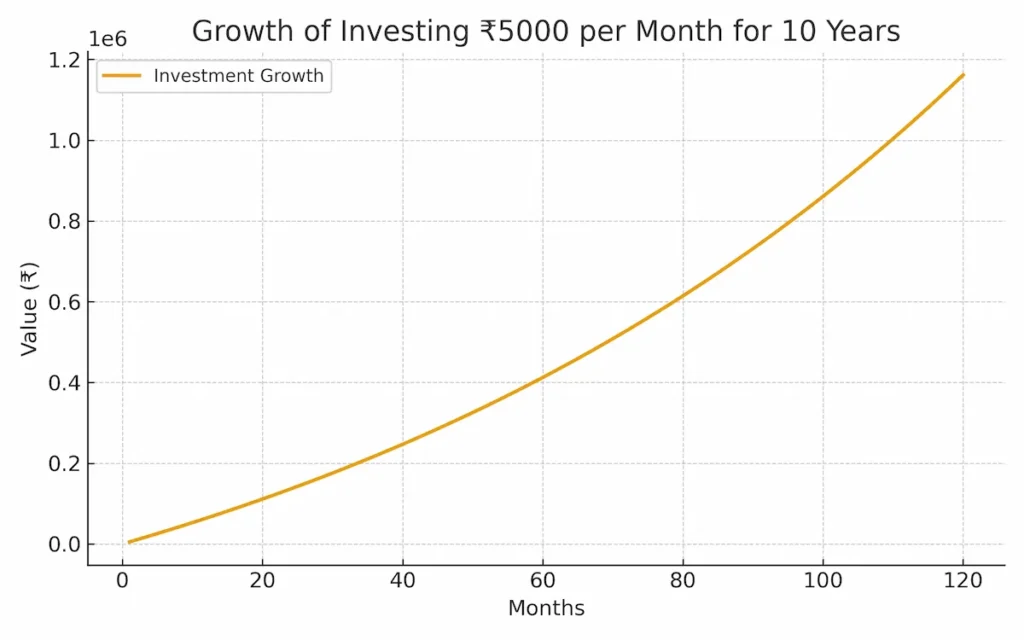

In SIP, you invest a fixed amount (₹500, ₹1000, ₹5000, or more) every month into a mutual fund scheme.

The biggest advantage of SIP is the Power of Compounding. With consistent investments, your money grows steadily over time and helps you build a strong financial future.

Who Should Invest in Mutual Funds in India?

Mutual funds are suitable for:

SIP is a popular method for investing in Mutual Fund in India, allowing for disciplined savings.

- Individuals with long-term financial goals.

- People planning for retirement, children’s education, marriage, or buying a home.

- Investors who want better returns than bank savings accounts, FDs, or RDs.

- Beginners who want a disciplined and convenient way of investing with small amounts.

Government Support for Mutual Fund Investors

Mutual funds in India have become one of the most popular investment options for building long-term wealth. But what makes them safe and trustworthy is the strong support and regulations provided by the Government of India.

The government, along with regulatory bodies, ensures that mutual fund investors enjoy safety, transparency, tax benefits, and easy digital access. Let’s understand in detail how the government helps in mutual fund investment.

Regulation & Safety (SEBI Oversight)

Investing in Mutual Fund in India is suitable for individuals with varying financial goals.

- All mutual funds in India are regulated by SEBI (Securities and Exchange Board of India), which works under the Government of India.

- SEBI ensures that mutual fund companies follow strict rules and protect investors’ money.

- Fund houses must disclose their portfolio, Net Asset Value (NAV), and charges on a regular basis.

- This creates transparency and ensures that investors know exactly where their money is being invested.

- Thanks to SEBI’s oversight, mutual funds are considered one of the most regulated and trusted investment options in India.

Tax Benefits on Mutual Fund Investment

The government also provides attractive tax-saving benefits through mutual funds:

- ELSS (Equity Linked Savings Scheme): Investors can claim up to ₹1.5 lakh deduction every year under Section 80C of the Income Tax Act.

- Long-Term Capital Gains (LTCG): Profit up to ₹1 lakh in a financial year is completely tax-free. Beyond this, only 10% tax is applicable, which is much lower compared to many other investment products.

- This makes mutual funds not just wealth-building tools but also a smart tax-saving option.

Investor Protection & Awareness Programs

Government regulations provide a safety net for those investing in Mutual Fund in India.

The Government also promotes investor protection through initiatives like:

- AMFI (Association of Mutual Funds in India): Educates investors about safe investing practices.

- Campaigns like “Mutual Funds Sahi Hai”, supported by SEBI, have increased awareness among millions of Indians.

- Investors can raise complaints directly through SEBI’s SCORES platform if they face any issue with fund houses.

Digital Access & Convenience

- Aadhaar-based e-KYC makes online investing super easy.

- Payments can be made via UPI, Net Banking, Mobile Apps.

- Start investing with just ₹500 per month.

Conclusion

Mutual funds are one of the smartest and most reliable ways to build wealth in India. With small but consistent investments through SIPs, you can achieve your biggest financial goals without burdening your pocket.

Always remember: Every investment carries some level of risk. So, choose the right fund based on your financial goals, time horizon, and risk tolerance.

📈 Invest with Us – Mutual Fund SIP

Begin your smart investing journey with Mutual Fund SIPs. Make your money work for you with trusted investment guidance.

ARN Number: 313264

🚀 Start Your SIP NowDisclaimer: Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.

Yes, mutual funds are regulated by SEBI, making them one of the safest investment options. However, they still carry some market risk.

You can start with as little as ₹500 per month through SIP (Systematic Investment Plan).

Yes, except for ELSS (3-year lock-in), most mutual funds allow withdrawal anytime. However, equity funds may charge a small exit load if redeemed before 1 year.

Beginners can start with Index Funds, Balanced Funds, or ELSS (for tax saving) depending on their goals.

Mutual funds offer diversification, professional management, higher returns compared to savings accounts, tax benefits, and easy digital access with small investments.

Yes, mutual funds are safer because professionals manage them, and risk is spread across multiple stocks.

Tax benefits associated with Mutual Fund in India make them an attractive investment option.

Awareness about Mutual Fund in India is crucial for new investors looking to enter the market.

Digital access to Mutual Fund in India has transformed the investment landscape for many.

Conclusion: The growth of Mutual Fund in India offers numerous opportunities for investors.

In summary, investing in Mutual Fund in India can be a strategic step toward financial security.

Investors eyeing stability should consider the advantages of Mutual Fund in India.

For anyone looking to invest, exploring Mutual Fund in India is a wise choice.