Choosing the best mutual fund schemes 2025 can help you build wealth systematically through SIP options starting from ₹500 per month..

🎧 Prefer listening?

Before you start reading, listen to a short Hindi audio overview of this post — it gives you a quick idea about the topic in just a minute.

Investing in mutual funds is one of the smartest ways to grow your wealth in 2025. With SIP options starting from just ₹500, anyone can begin their financial journey. Here, we share some of the best mutual fund schemes you can consider.

Top 6 Best Mutual Fund Schemes in India 2025

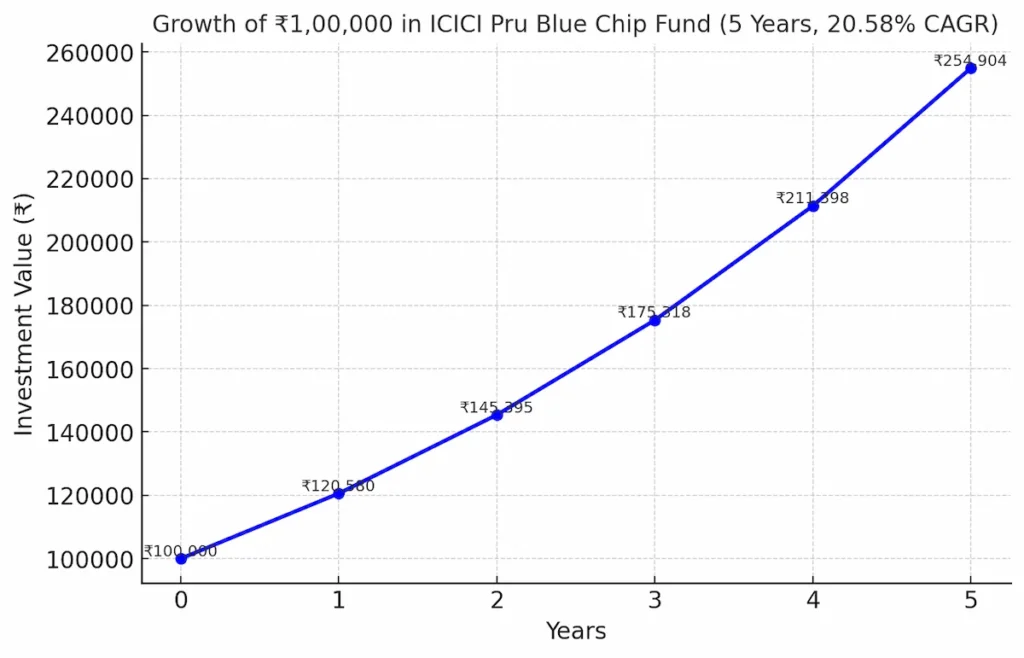

1. ICICI Pru Blue Chip Fund (Large Cap)

Fund Overview

- Fund Name: ICICI Prudential Large Cap Fund – Growth (previously Bluechip Fund)

- Category: Large-Cap Equity

- Launch Date: 5 May 2008

- Fund House: ICICI Prudential Mutual Fund — India’s second-largest AMC

- Fund Manager: Anish Tawakley

- AUM: ₹71,787 Cr

Fund Performance (as of mid-2025)

| Period | Fund Return % |

| 3 Years(CAGR) | 19.04% |

| 5 Years(CAGR) | 20.58% |

| 10 Years(CAGR) | 14.34% |

| Since Inception (CAGR) | 14.84% |

Risk Metrics & Ratios

- Sharpe Ratio: 1.08 — indicates strong risk-adjusted returns (higher than benchmark)

- Alpha: 4.48 — shows the fund has outperformed its benchmark by ~4.5% more

- Beta: 0.89 — indicates lower volatility than the benchmark (more stable)

- Standard Deviation: 11.76 — lower than many peers, signaling consistency

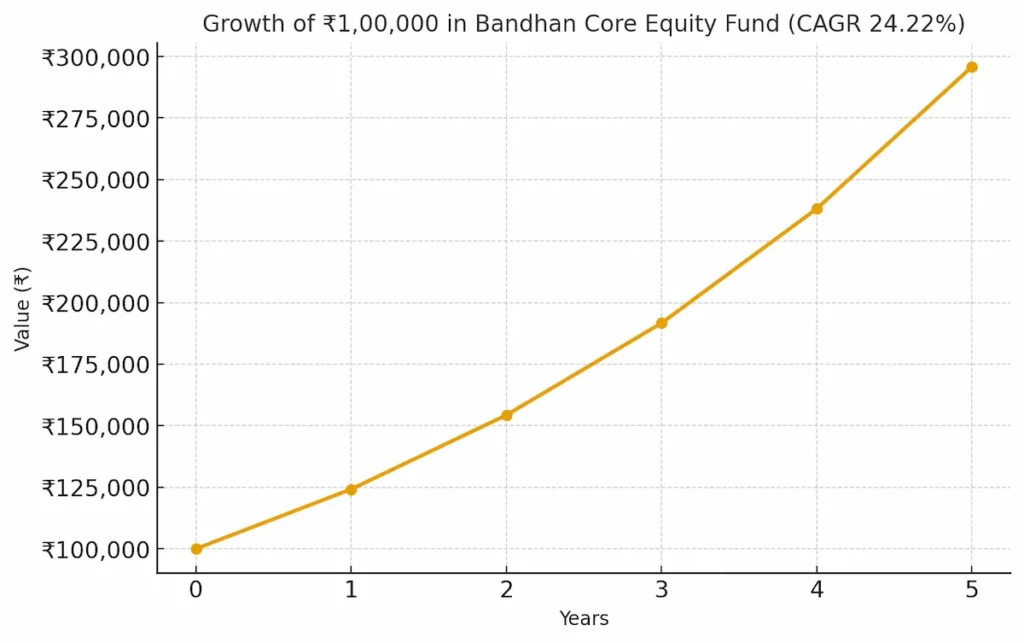

2. Bandhan Core Equity Fund (Mix of Large & Midcap)

Fund Overview

- Name: Bandhan Core Equity Fund – Growth

- Category: Large & Mid Cap Equity

- Launch Date: 01 January 2013 → 12 years, 7 months of history.

- AUM: ₹9,997 Crores (as on mid-2025).

- Fund Manager : Manish Gunwani

Fund Performance

| Period | Return % |

| 3 Years (CAGR) | +23.34% |

| 5 Years (CAGR) | +24.22% |

| 10 Years (CAGR) | +15.87% |

| Since Inception | +13.72% |

Risk Metrics & Ratios

- Sharpe Ratio: 1.25 — (indicating strong risk-adjusted performance)

- Alpha: 2.57% — shows the fund has outperformed its benchmark by ~2.6% more

- Beta: 0.99 — closely mirrors market moves

- Standard Deviation: 13.41% — signaling moderate volatility

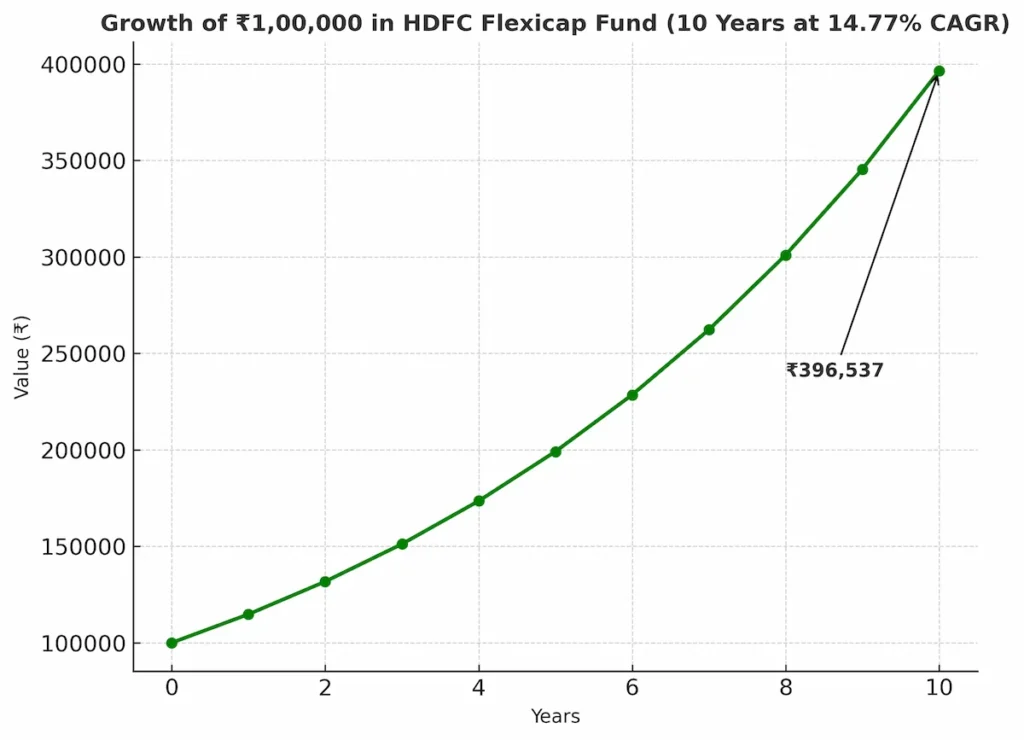

3. HDFC Flexicap Fund

Fund Overview

- Name: HDFC Flexi Cap Fund – Growth Plan

- Category: Dynamic Flexi-Cap (Equity across Large, Mid & Small caps)

- Launch Date: 1 January 1995

- AUM: approx. ₹80,000 cr as of mid-2025

- Expense Ratio: ~1.38% (Regular Plan)

- Fund Managers: Roshi Jain

Fund Performance

| Period | Return % |

| 3 Years (CAGR) | +22.1% |

| 5 Years (CAGR) | +27.95% |

| 10 Years (CAGR) | +14.77% |

| Since Inception | +18.78% |

Risk & Efficiency Metrics

- Sharpe Ratio: ~1.23 (strong risk-adjusted returns)

- Alpha: ~7.71 % (outperformed benchmark)

- Beta: ~0.88 (lower volatility)

- Standard Deviation: ~12.12 (well-controlled fluctuations)

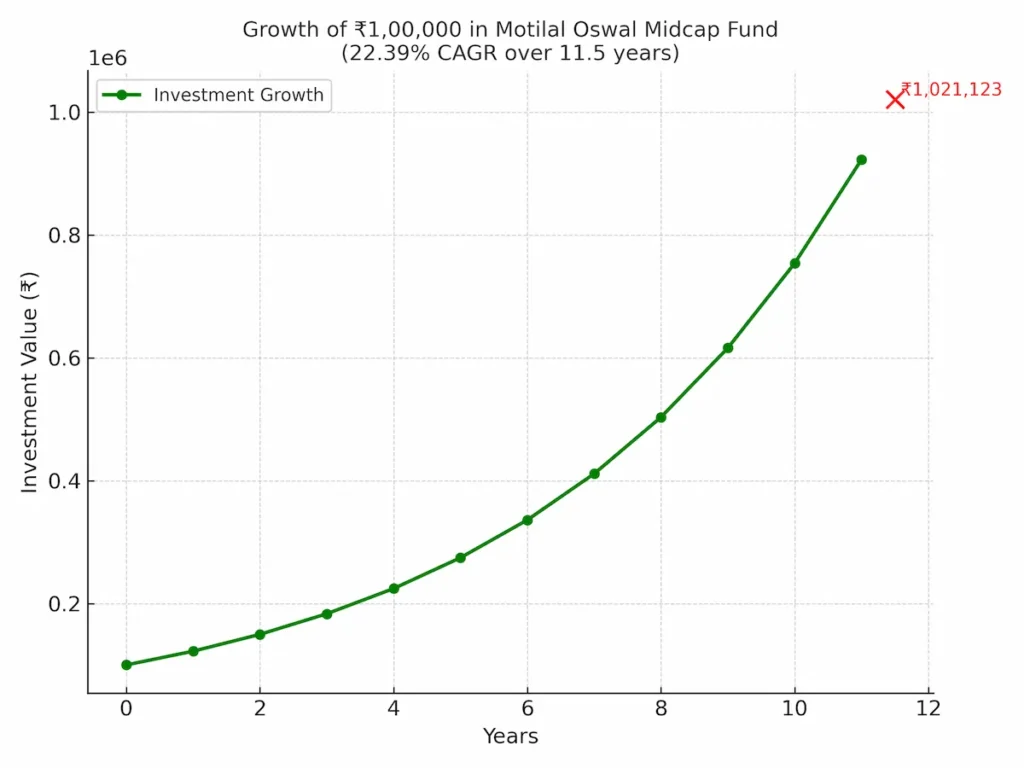

4. Motilal Oswal Midcap Fund

Fund Overview

- Category: Mid-Cap Equity

- Launch Date: 2 February 2014

- Expense Ratio: ~1.56%

- AUM: ₹33,608 Crore (as of July 2025)

- Benchmark: NIFTY Midcap 150 TRI

- Fund Managers: Niket Shah, Rakesh Shetty, Sunil Sawant and Ajay Khandelwal

Fund Performance

| Period | Return % |

| 3 Years (CAGR) | +28.0% |

| 5 Years (CAGR) | +32.27% |

| 10 Years (CAGR) | +17.52% |

| Since Inception | +22.39% |

Risk & Efficiency Metrics

- Standard Deviation: 13.31%

- Sharpe Ratio: 1.26 A Sharpe Ratio above 1 indicates strong risk-adjusted returns.

- Alpha: 5.96% An Alpha of nearly 6% shows the fund outperformed its benchmark significantly.

- Beta: 0.88 A Beta below 1 suggests lower volatility relative to the benchmark.

5. Bank of India Small Cap Fund

Fund Overview

- Launch Date: December 19, 2018

- Category: Small-Cap Equity (Very High Risk)

- Benchmark: NIFTY Smallcap 250 Total Return Index (TRI)

- Expense Ratio: 2.03%

- AUM: ~₹1,937 Crore (as of mid-2025)

- Fund Managers: Alok Singh and Nav Bhardwaj

Fund Performance

| Period | Return % |

| 3 Years (CAGR) | +21.15% |

| 5 Years (CAGR) | +29.44% |

| Since Inception | +27.28% |

Risk & Efficiency Ratios

- Sharpe Ratio: –0.39 (indicates risk-adjusted performance below benchmark)

- Alpha: 9.61 (indicates outperformance over expected return)

- Standard Deviation: 22.58 (shows high volatility)

6. SBI Long Term Equity (ELSS Fund for Tax Saving)

Fund Overview

- Scheme name: SBI Long Term Equity Fund

- Category: Equity — ELSS (Tax-saving with 3-year statutory lock-in).

- Inception / Launch: 7 May 2007

- AUM: ₹30,000+ crore .

- Fund manager: Dinesh Balachandran

Performance snapshot

| Period | Return % |

| 3 Years (CAGR) | +24.4% |

| 5 Years (CAGR) | +24.7% |

| Since Inception | +16.9% |

Key risk & efficiency ratios

- Sharpe Ratio: ~1.3 — indicating good risk-adjusted returns vs category average

- Standard Deviation: ~13.3%–13.4% moderate volatility vs peers

- Beta: ~0.95–1.0 (close to market behaviour).

Why Choose These Schemes?

- Good past performance

- Diversified portfolio

- SIP available from ₹500

- Tax saving (ELSS) benefit up to ₹1.5 lakh under Section 80C

Start small, stay consistent, and let compounding grow your money. Mutual funds are designed for long-term wealth creation, and 2025 is the right time to begin.

📈 Invest with Us – Mutual Fund SIP

Begin your smart investing journey with Mutual Fund SIPs. Make your money work for you with trusted investment guidance.

ARN Number: 313264

🚀 Start Your SIP NowDisclaimer: Mutual Fund investments are subject to market risks. Please read all scheme-related documents carefully before investing.

Large Cap (ICICI Pru Bluechip Fund): For conservative investors seeking stability.

Large & Midcap (Bandhan Core Equity Fund): For balanced investors who want growth + stability.

Flexicap (HDFC Flexicap Fund): For investors who want diversification without worrying about market cap.

Midcap (Motilal Oswal Midcap Fund): For investors with high risk appetite and long-term vision.

Small Cap (Bank of India Small Cap Fund): For aggressive investors aiming for high growth with high risk.

ELSS/Tax Saving (SBI Long Term Equity Fund): For investors who want tax benefits + wealth creation.

SBI Long Term Equity Fund (ELSS) qualifies for tax deduction under Section 80C (up to ₹1.5 lakh).

Low to Moderate Risk: Large Cap, Flexicap

Moderate to High Risk: Large & Midcap, Midcap

High Risk: Small Cap

Moderate Risk + Tax Saving: ELSS

Stable wealth: ICICI Pru Bluechip (Large Cap), HDFC Flexicap

Balanced growth: Bandhan Core Equity Fund

Aggressive growth: Motilal Oswal Midcap, BOI Small Cap

Tax-saving + growth: SBI Long Term Equity Fund