Personal Loan | Home Loan | Business Loan | Used Vehicle Loan | Loan Against Securities

Best Personal Loan, Home Loan, Business Loan, Used Vehicle Loan & Securities Loan Options in 2025 – Explore 20+ best choices with Benefits, interest Rates & Eligibility. Compare top banks & fintech offers to find the right loan for your needs.

🎧 Prefer listening?

Before you start reading, listen to a short Hindi audio overview of this post — it gives you a quick idea about the topic in just a minute.

When people need money quickly, personal loans are one of the most common choices in India. They are fast, paperless, and can be used for many purposes—like emergencies, weddings, travel, education, or medical expenses. But just like any other financial product, they have both good sides and bad sides.

In this guide, we will look at 17 personal loan providers, along with one business loan, one home loan option, and explain their benefits, risks, and best choices.

Table of Contents

Best Used Vehicle Loan in India 2025

A Used Vehicle Loan helps you buy a second-hand vehicle without paying the full amount upfront. You can take a loan and repay it in easy EMIs over a set period.

- Key Features:

- Get upto 100% loan for a pre-owned car value.

- Get a loan on a wide range of cars and multi-utility vehicles.

- Receive a Used Car Loan of up to 3 to 6 times your annual income.

- The age of your car at loan maturity should not exceed 10 years.

- The maximum loan tenure you can select is 60 months.

- Fees & Charges:

- Interest Rate : 12% Onwards

- File charge: min 1% + GST (depends on bank)

- Vehicle Valuation/Asset Verification Charges*: Rs. 750/- (Depends on bank)

- Eligibility:

- People looking for affordable vehicle financing. (second-hand vehicle)

- Salaried & self-employed individuals

- Minimum age: 21 years

- Customer with stable income from either of the following sources:

- Salaried Individuals – Earning a fixed monthly salary from a company or organization.

- Self-Employed Professionals – Doctors, lawyers, consultants, or freelancers with regular business income.

- Business Owners – Entrepreneurs running small or medium-sized businesses with consistent earnings.

- Documents Required:

- 1. PAN Card

- 2. Aadhaar Card

- 3. RC (Registration certificate)

- 4. Insurance

- 5. Light bill

- 6. Mobile Number

- Step by step Application process:

- Open the product link

- Enter basic details

- First Name, Last Name

- Date of Birth (DOB)

- Email Address, Mobile Number

- Gender, Pincode

- Click ‘Submit’ to complete the request.

- A representative will contact for the next steps.

Best Loan against Securities (Mutual Funds and Stocks) in India 2025

Abhiloans (Loan against Mutual Fund, shares and other securities)

- Benefits:

- Get Instant money without selling your mutual fund or shares.

- Keep earning return on your investment while borrowing.

- Interest rate: From 8% per annum

- Processing fee: Only 2%.

- Instant Loan Disbursal from ₹10,000 to ₹1 Cr rupees

- Loan starting from ₹10,000 , up to 75% of your mutual fund , shares or Other securities value.

- 100% digital paperless process

- Zero foreclosure charges

- minimal documentation required.

- No income proof or cibil score needed.

- Only pay interest amount monthly.

- Eligibility:

- If you have mutual funds/ shares / bonds etc. worth ₹20,000 then apply.

- If don’t have first invest in mutual funds/ shares / bonds etc. through SIP or Lamp sum then apply in next 2 days.

- Tax saver mutual funds (ELSS fund schemes) are not eligible for this loan.

- Documents Required

- 1. Mobile Number linked with Aadhaar card and PAN card.

- 2. Email ID linked with your mutual fund or other investment (Registered with CAMS).

- 3. Digilocker’s ID and password for KYC documents.

- 4. If you have shares then Demat account details (NSDL or CDSL account detail)

- Application Process:

- Open the product link

- Verify Aadhaar and PAN linked mobile number Using OTP

What is a Personal Loan?

A personal loan is an unsecured loan—meaning you don’t need collateral like property or gold. Banks, NBFCs, and fintech companies provide it with flexible repayment tenure.

Pros (Positive Side):

- Quick disbursal (sometimes within 24 hours).

- 100% paperless application.

- Multipurpose usage.

- Improves credit history (if repaid on time).

Cons (Negative Side):

- High interest rates (10%–30%).

- Processing fees.

- Can create a debt trap if over-borrowed.

Best Personal Loans in India 2025

1. Aditya Birla Personal Loan

- Benefits:

- 100% digital paperless process

- Instant Loan Disbursal upto 5 Lakhs

- Flexible Tenure from 12 to 48 months

- Eligibility:

- Age: 23 to 60 years

- Credit score: >725

- Monthly Income: ₹30000

- Only for salaried employees

- Documents Required

- PAN Card

- Aadhaar Card

- Last 6 months bank statement via net banking so keep remember your customer ID and Password to Login

- Last 3 months salary slip

- Two contact details of your family or friend for reference check

- keep remember your customer ID and Password to Login into net banking of Bank account or debit card details for E-mandate.

- Application Process:

- Open the product link

- Verify Aadhaar and PAN linked mobile number Using OTP

- Fill basic details according to the PAN Card

- Fill Personal and Professional details

- processed to complete application (If not eligible for this loan try another that good for you)

2. MoneyView Personal Loan

- Amount: ₹5000 to ₹5 lakh

- Interest Rate: From 1.33%per month

- Processing Fee: from 2%

- Tenure: up to 60 months

- Loan Processing Time: Up to 24 hours

- No salary slip required

- monthly income required:- ₹13500

- Credit score >600

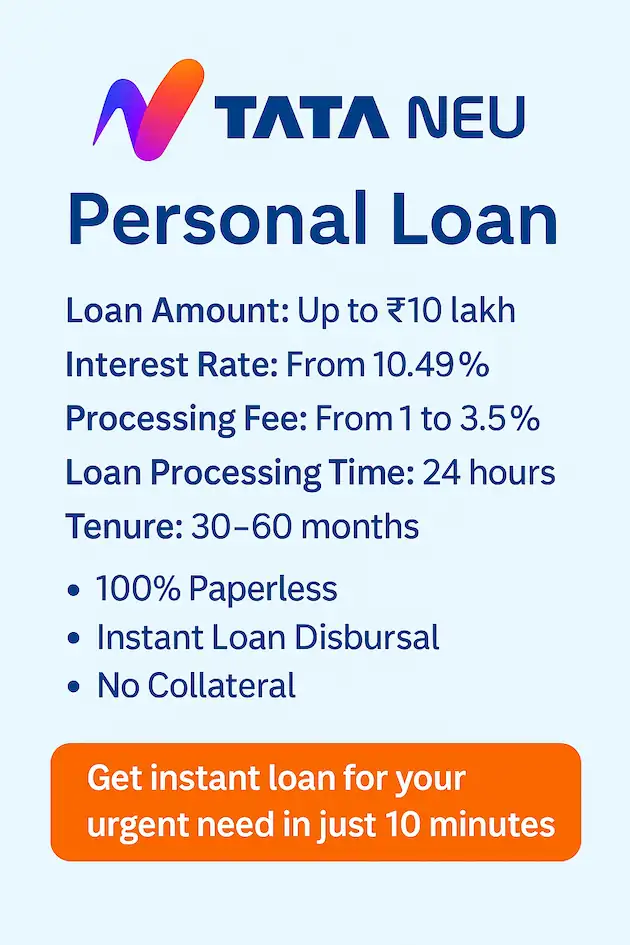

3. TATA NEU Personal Loan

- Loan Amount: Up to ₹10 lakh

- Interest Rate: From 10.49%

- Processing Fee: From 1% to 3.5%

- Loan Processing Time: 24 hours

- Tenure: 30–60 months

- 100% Paperless

- Instant Loan Disbursal

- No Collateral Required

4. Bajaj Finserv Personal Loan

- Loan Amount: Up to ₹15 lakh

- Interest Rate: From 16% to 31%

- Processing Fee: 3.93%

- Loan Processing Time: 24 hours

- Tenure: 30–60 months

- 100% Paperless

- Instant Loan Disbursal

- No Collateral Required

5. HDFC Insta Jumbo Loan

- Loan Amount: Up to ₹10 lakh

- Interest Rate: From 12%

- Processing Fee: Low processing fee

- Loan Processing Time: 24 hours

- Tenure: 30–60 months

- 100% Paperless

- Instant Loan Disbursal

- Only for existing HDFC Bank Credit card Holders

6. IDFC First Bank Personal Loan

- Benefits:

- Loan tenure: 1 to 5 years.

- Processing fee: up to 2%.

- Interest rate: From 9.99% per annum

- 100% digital paperless process

- Instant Loan Disbursal up to ₹10 Lakhs

- Zero foreclosure charges

- minimal documentation required.

- Eligibility:

- Age: 25 to 60 years

- Credit score: >730

- Documents Required

- PAN Card

- Aadhaar Card

- keep remember your customer ID and Password to Login into net banking of Bank account or debit card details for E-mandate.

- Application Process:

- Open the product link

- Verify Aadhaar and PAN linked mobile number Using OTP

- Fill basic details according to the PAN Card

- Fill Personal and Professional details

- processed to complete application (If not eligible for this loan try another that good for you)

7. Poonawalla Fincorp Personal Loan

- Amount: Up to ₹5 lakh

- Interest Rate: From 16%

- Processing Fee: Up to 4.5%

- Tenure: 12–36 months

- 100% Paperless

8. IndusInd Bank Personal Loan

- Amount: Up to ₹5 lakh

- Interest Rate: From 10.49%

- Processing Fee: Up to 1.5%

- Tenure: 12–48 months

- Processing Time: 2–3 days

- 100% Paperless

9. Ram Fincorp Instant Personal Loan

- Loan Amount: 1000 to ₹10 lakh

- Interest Rate: From 36%

- Processing Fee: From 2%

- Tenure: 12–60 months

- 100% Online- No calls, no queues, no hassle

- Instant Loan Disbursal to your bank account

- No Collateral, No hidden Charges

- No foreclosure fees- close any time

10. Creditt+ Personal Loan

- Loan Amount: ₹10,000 to ₹35,000

- Loan Processing Time: 24 hours

- 100% Paperless

- Instant Loan Disbursal

- No Collateral Required

11. InCred Personal Loan

- Loan Amount: Up to ₹10 lakh

- Interest Rate: From 1.33% per month

- Processing Fee: From 1% to 3.5%

- Loan Processing Time: 24 hours

- Tenure: 12 to 60 months

- 100% Paperless

- Instant Loan Disbursal

- No Collateral Required

- monthly income required more than ₹15000 per month

- Credit score more than 650

12. Prefr Personal Loan

- Amount: Up to ₹5 lakh

- Interest Rate: From 18%

- Processing Fee: Up to 5%

- Tenure: 12–48 months

- Loan Processing Time: Up to 24 hours

- No salary slip required

13. KreditBee Personal Loan

- Amount: Up to ₹5 lakh

- Interest Rate: From 16%

- Processing Fee: 2% to 5%

- Tenure: 3–24 months

- Loan Processing Time: Up to 24 hours

- No salary slip required

14. Hero Instant Loan

- Loan Amount: Up to ₹5 lakh

- Interest Rate: From 19%

- Processing Fee: 2.5%

- Loan Processing Time: up to 24 hours

- Tenure: 12–36 months

- 100% Paperless

- Instant Loan Disbursal

- Monthly income :- more than ₹25000 to apply

- Required Cibil score :- above 720

- Applicant age limit :- between 25 to 45 years

15. Bharat Personal Loan

- Benefits:

- Loan tenure: 1 to 3 years.

- Processing fee: from 2%.

- Interest rate: From 36% per annum

- 100% digital paperless process

- Instant Loan Disbursal from ₹5000 to ₹1 Lakhs in just 30 minutes.

- No credit check need.

- minimal documentation required.

- Eligibility:

- Age: 25 to 50 years

- Monthly Income: ₹30000

- Only for salaried employees

- Documents Required

- PAN Card

- Aadhaar Card

- keep remember your customer ID and Password to Login into net banking of Bank account or debit card details for E-mandate.

- Application Process:

- Open the product link

- Verify Aadhaar and PAN linked mobile number Using OTP

- Fill basic details according to the PAN Card

- Fill Personal and Professional details

- Processed to complete application (If not eligible for this loan try another that good for you)

16. Rupee 112 Personal Loan

- Benefits:

- Loan tenure: 1 to 3 years.

- Processing fee: from 2%.

- Interest rate: From 36% per annum

- 100% digital paperless process

- Instant Loan Disbursal from ₹5000 to ₹1 Lakhs in just 30 minutes.

- No credit check need.

- minimal documentation required.

- Eligibility:

- Age: 25 to 50 years

- Monthly Income: ₹30000

- Only for salaried employees

- Documents Required

- PAN Card

- Aadhaar Card

- keep remember your customer ID and Password to Login into net banking of Bank account or debit card details for E-mandate.

- Application Process:

- Open the product link

- Verify Aadhaar and PAN linked mobile number Using OTP

- Fill basic details according to the PAN Card

- Fill Personal and Professional details

- Processed to complete application (If not eligible for this loan try another that good for you)

17. Smartcoin Personal Loan

- Benefits:

- Instant Loan Disbursal up to ₹1 Lakhs

- Interest rate: From 2% per months

- Loan tenure: 3 to 9 months.

- Processing fee: from 5%.

- 100% digital paperless process

- Zero foreclosure charges

- minimal documentation required.

- Eligibility:

- Age: 24 to 45 years

- Credit score: >650

- Documents Required

- PAN Card

- Aadhaar Card

- keep remember your customer ID and Password to Login into net banking of Bank account or debit card details for E-mandate.

- Application Process:

- Open the product link

- Verify Aadhaar and PAN linked mobile number Using OTP

- Fill basic details according to the PAN Card

- Fill Personal and Professional details

- Processed to complete application (If not eligible for this loan try another that good for you)

Best Business Loan in India 2025

Aditya Birla Udyog Plus Business Loan

- Benefits:

- Instant Loan Disbursal up to ₹30 Lakhs for SME”s

- Interest rate: From 18% per annum

- 100% digital paperless process

- Eligibility:

- Age: 23 to 65 years

- minimum business vintage: 1 year (with GST/Udhyam+)

- Documents Required:

- Business PAN number

- Digilocker login Id and Password for KYC

- Keep remember your customer ID and Password to Login into net banking of Bank account or debit card details for E-mandate.

- Last 6 months Bank statement

- Application Process:

- Open the product link

- Verify Aadhaar and PAN linked mobile number Using OTP

Best Home Loan in India 2025

Basic Home Loan

- Benefits:

- Minimum Loan Amount:- ₹25 lakhs

- 100% digital paperless process

- step by step tracking

- Eligibility:

- Age: 18+ years

- Minimum income:- ₹35,000

- Documents Required

- PAN Card

- Aadhaar Card

- Property proof

- Digilocker login Id and Password for KYC

- Keep remember your customer ID and Password to Login into net banking of Bank account or debit card details for E-mandate.

- Application Process:

- Open the product link

- Verify Aadhaar and PAN linked mobile number Using OTP

Required Documents (Common for All Loan Types)

- PAN Card

- Aadhaar Card

- Salary slips / Bank statement (if required)

- Net banking login or Debit card details for e-mandate

- Mobile number linked to Aadhaar

Best Personal Loan Options in 2025

| Lender / Platform | Loan Amount (₹) | Interest Rate (p.a. / per month) | Processing Fee | Key Highlights / Features |

|---|---|---|---|---|

| 1. Aditya Birla Personal Loan | ₹50,000 – ₹5,00,000 | From 11.5% p.a. | 1% – 2% | For salaried; 100% digital; flexible tenure |

| 2. MoneyView Personal Loan | ₹5,000 – ₹5,00,000 | From 1.33% per month | From 2% | No salary slip required; instant approval |

| 3. TATA NEU Personal Loan | Up to ₹10,00,000 | From 10.49% p.a. | 1% – 3.5% | 100% paperless; no collateral |

| 4. Bajaj Finserv Personal Loan | Up to ₹15,00,000 | From 16% – 31% p.a. | Up to 3.93% | No collateral; flexible EMI; instant approval |

| 5. HDFC Insta Jumbo Loan | Up to ₹10,00,000 | From 12% p.a. | Low | For existing HDFC Credit Card holders |

| 6. IDFC First Bank Personal Loan | Up to ₹10,00,000 | From 9.99% p.a. | Up to 2% | Zero foreclosure; 100% digital process |

| 7. Poonawalla Fincorp Personal Loan | Up to ₹5,00,000 | From 16% p.a. | Up to 4.5% | No collateral; quick approval |

| 8. IndusInd Bank Personal Loan | Up to ₹5,00,000 | From 10.49% p.a. | Up to 1.5% | Paperless process; fast disbursal |

| 9. Ram Fincorp Personal Loan | ₹1,000 – ₹10,00,000 | From 36% p.a. | From 2% | 100% online; no foreclosure fees |

| 10. Creditt+ Personal Loan | ₹10,000 – ₹35,000 | Variable | Nil | Micro-loan; instant approval; no collateral |

| 11. InCred Personal Loan | Up to ₹10,00,000 | From 1.33% per month | 1% – 3.5% | Paperless; instant disbursal; flexible EMI |

| 12. Prefr Personal Loan | Up to ₹5,00,000 | From 18% p.a. | Up to 5% | No salary slip required; instant process |

| 13. KreditBee Personal Loan | Up to ₹5,00,000 | From 16% p.a. | 2% – 5% | Fintech-based; minimal documentation |

| 14. Hero Instant Loan | Up to ₹5,00,000 | From 19% p.a. | 2.5% | For salaried professionals; high approval |

| 15. Bharat Personal Loan | ₹5,000 – ₹1,00,000 | From 36% p.a. | From 2% | No credit check; 100% digital |

| 16. Rupee112 Personal Loan | ₹5,000 – ₹1,00,000 | From 36% p.a. | From 2% | Instant approval; minimal documentation |

| 17. SmartCoin Personal Loan | Up to ₹1,00,000 | From 2% per month | From 5% | Zero foreclosure; instant transfer |

Final Thoughts

In 2025, digital lending has made borrowing simpler and faster. Whether you’re buying a home, expanding a business, or managing emergencies, choose a lender offering low rates, quick approval, and flexible repayment.

Pro Tip: Compare total cost (interest + processing fee) before applying — not just the advertised rate.

What is the minimum salary to get a personal loan in India?

Most lenders require a minimum monthly income of ₹15,000–₹30,000, depending on the bank or fintech platform.

Which loan gives instant approval in 5 minutes in India?

MoneyView, KreditBee, and SmartCoin offer instant loan approval in under 5 minutes with only Aadhaar, PAN, and bank verification. Disbursal happens within 30 minutes to 2 hours for eligible users.

Can I get a loan without a credit score?

Yes, lenders like Rupee112 and AbhiLoans (against securities) offer loans without a CIBIL check.

What is the lowest interest rate on personal loans in 2025?

As of 2025, the lowest personal loan interest rates start at 9.99% per annum from IDFC First Bank and HDFC Bank, depending on your income, credit score, and employer type.

Can I take a loan using my mutual funds or shares?

Yes, you can apply for a Loan Against Securities through AbhiLoans — you’ll continue earning returns on your investments while borrowing.

What documents are required for an instant personal loan?

You’ll usually need only Aadhaar, PAN, and bank statement (last 3–6 months). Some lenders also ask for salary slips or net banking login to verify income digitally.

Which is better — a secured loan or an unsecured loan?

If you have assets like mutual funds, property, or gold, a secured loan (like a Loan Against Securities or Home Loan) offers lower interest rates.

If you don’t have collateral or need fast funds, go for an unsecured personal loan.

Can I close my loan early without paying extra charges?

Yes, many digital lenders such as Abhiloans and SmartCoin offer zero foreclosure charges, meaning you can repay the entire loan early without penalty.

Which Loan offer is best for ₹1 Lakh instant loan without salary slip?

If you don’t have a salary slip, you can still get a loan from SmartCoin, Rupee112, or Bharat Loan using Aadhaar, PAN, and bank statement verification.

Which is better: Personal Loan or Loan Against Securities?

If you own mutual funds, shares, or bonds, a Loan Against Securities (like Abhiloans) is better — you get lower interest (8% p.a.) and still earn returns on your investment.

Personal loans are better for those without investments or needing unsecured credit.

How to improve loan eligibility instantly?

Maintain a CIBIL score above 700

Reduce existing EMIs or credit card dues

Ensure salary credits reflect regularly

Apply with a co-applicant or guarantor

Use a loan eligibility calculator before applying

These actions can improve your approval chances and lower your interest rate.

Can I get a loan if my CIBIL score is below 600?

Yes, fintech platforms like SmartCoin, Rupee112, and Creditt+ offer loans with no or low credit checks.

However, such loans come with higher interest rates (up to 30–36%) and smaller amounts (₹5,000–₹1 Lakh).

How can I compare the best loan offers online?

Use TaazaLife’s Loan Comparison Table (2025) to compare:

Interest rates (p.a.)

Processing fees

Loan tenure

Approval time

Minimum income & CIBIL requirements

It helps you choose the best bank or fintech lender based on your profile.

- Best Zero Balance Savings & Business Bank Accounts in India 2025

- 20+ Best Personal Loan, Home Loan, Business Loan, Used Vehicle Loan & Securities Loan Options in 2025 – Benefits, Interest Rates & Eligibility

- Best Credit Cards in India 2025 – Complete Mega Guide (Cashback, Shopping, Travel, Fuel & Lifestyle)

- 5 Reasons Custodian in Mutual Funds Matters – Ignoring Their Role Could Put Your Money at Risk

- Best Mutual Fund Schemes to Invest in India 2025 – SIP Options & Smart Investment Guide